Average deductions from paycheck

Understanding paycheck deductions What you earn based on your wages or salary is called your gross income. Taxpayers can choose either itemized deductions or.

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android

Social Security tax and Medicare tax are two federal taxes deducted from your paycheck.

. The State Income Tax is 878 Social Security being 1612 the Medicare Insurance tax being 377 the State Disability Insurance SDI being. For example an employee with a. If you leave your.

The result is that the FICA taxes you pay are. They must only take 25 one week and then make another deduction from your next pay cheque for 25. Retroactive paycheck deductions of workers compensation premiums.

From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. What Percent of Taxes Is Deducted From My Paycheck. Your employer can take 10 of your gross earnings which is 25.

An employer has the right to make many types of deductions from an employees pay. The amount withheld per paycheck is 4150 divided by 26 paychecks or 15962. The standard deduction dollar amount is 12950 for single households and 25900 for married couples filing jointly for the tax year 2022.

Luckily when you file your taxes there is a deduction that allows you to deduct the half of the FICA taxes that your employer would typically pay. To calculate an employees gross pay start by identifying the amount owed each pay period. These deductions include the cost of work-specific uniforms tools meals.

For instance if you get paid bi-weekly and are a full-time hourly. Employers withhold or deduct some of their employees pay in order to cover. Hourly employees multiply the total hours worked by the hourly rate plus overtime and.

You need to save 5 of every paycheck if you start at age 25. These percentages are deducted from an employees gross pay for each paycheck. Gross pay is the total earning before any deductions.

The federal income tax deduction is 1435 yearly. This will help determine your withholding when completing a W-4. Generally employers may deduct from an employees paycheck one-half the Medical Aid Fund portion of the workers.

How Much Tax Is Deducted From A 1000 Paycheck. In each paycheck 62 will be withheld for Social Security taxes 62 percent of 1000 and. You need to save 10 if you start at age 35 22 if you start at age 45 and 52 of every paycheck if you start.

You pay the tax on only the first 147000 of your.

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

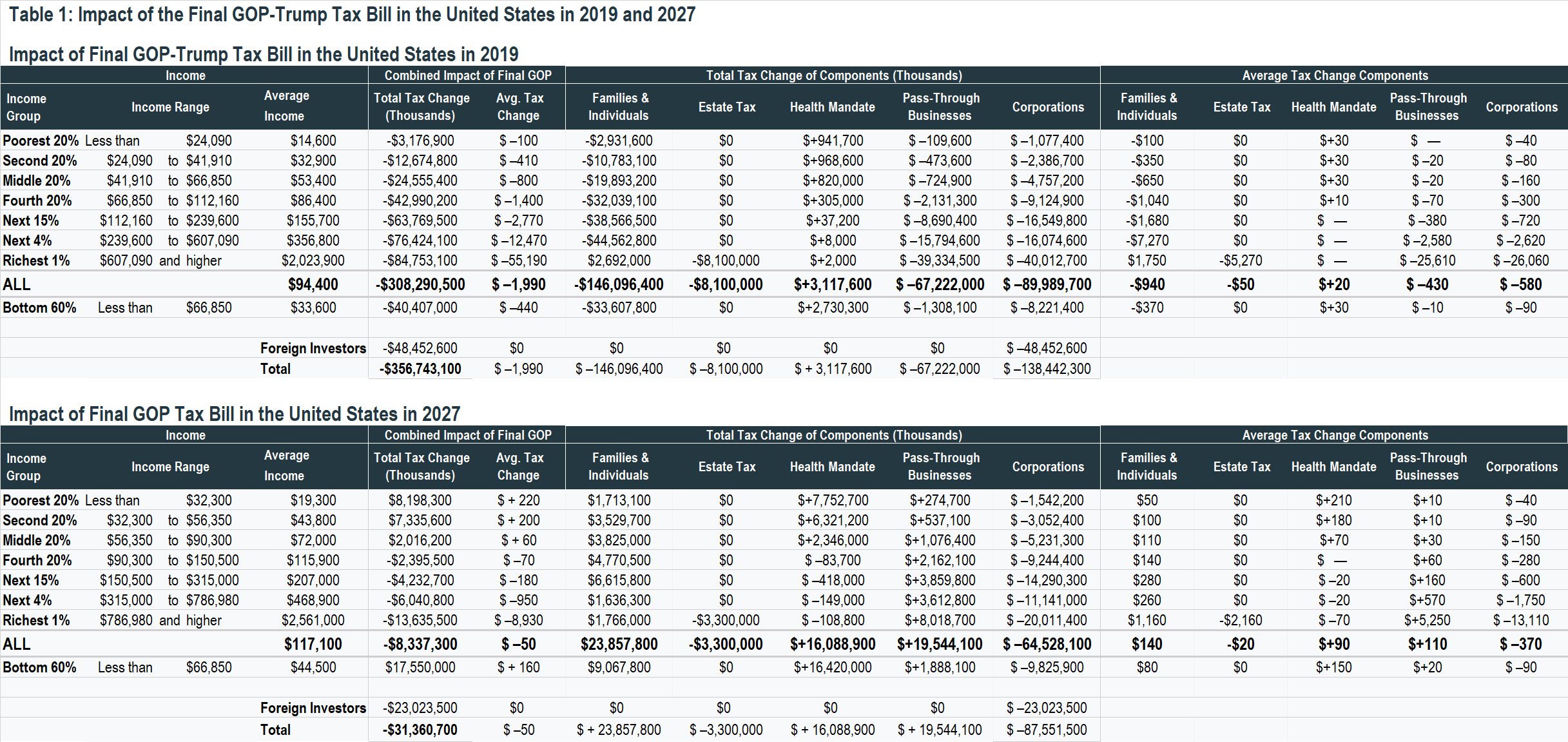

How Much Will Typical Middle Class Workers Really See Their Paychecks Change Itep

Here S How Much Money You Take Home From A 75 000 Salary

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Different Types Of Payroll Deductions Gusto

Understanding Your Paycheck Credit Com

Check Your Paycheck News Congressman Daniel Webster

Pay Stub Meaning What To Include On An Employee Pay Stub

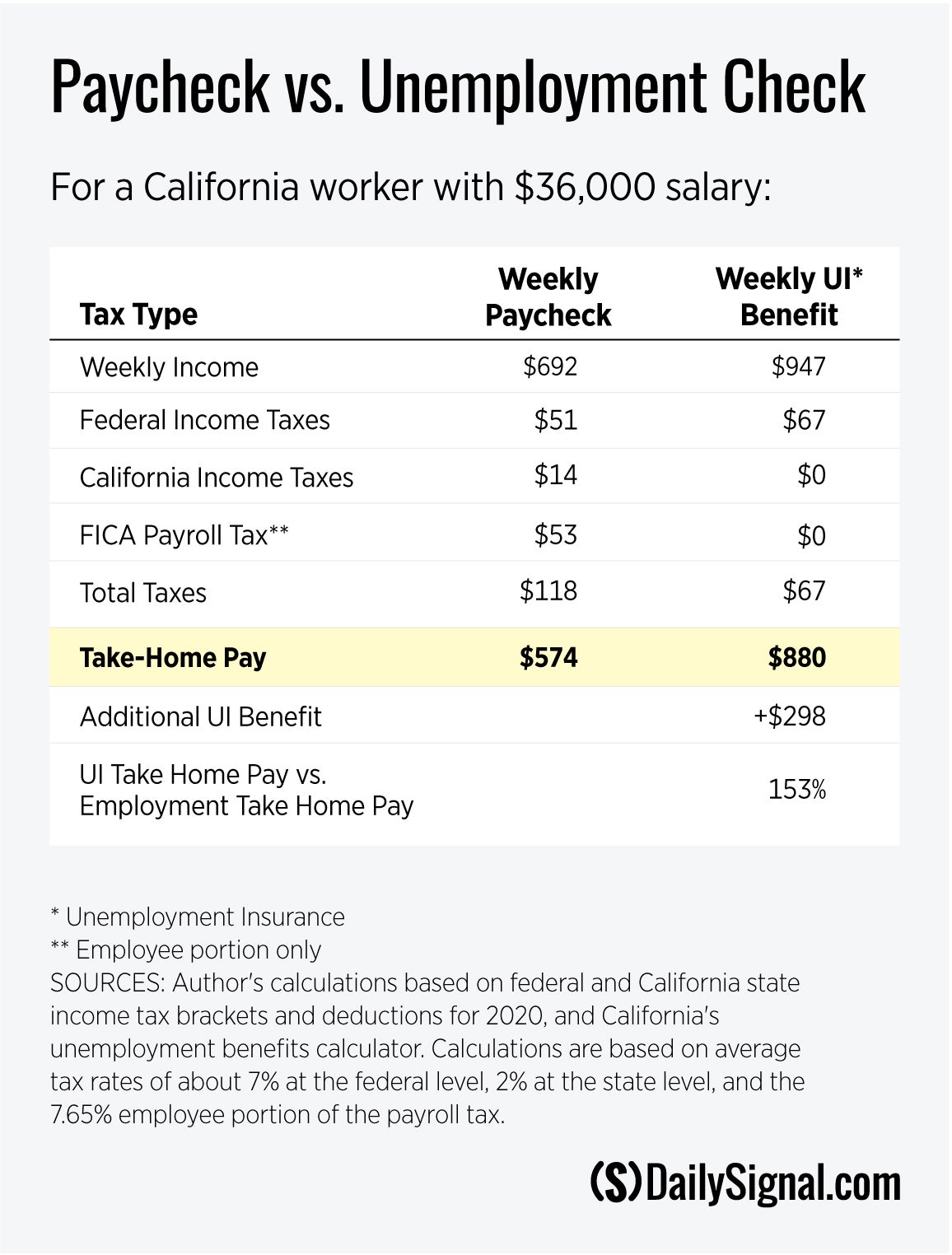

As Unemployment Keeps Rising Congress Needs To Fix What It Broke The Heritage Foundation

What Is Casdi Employer Guide To California State Disability Insurance Gusto

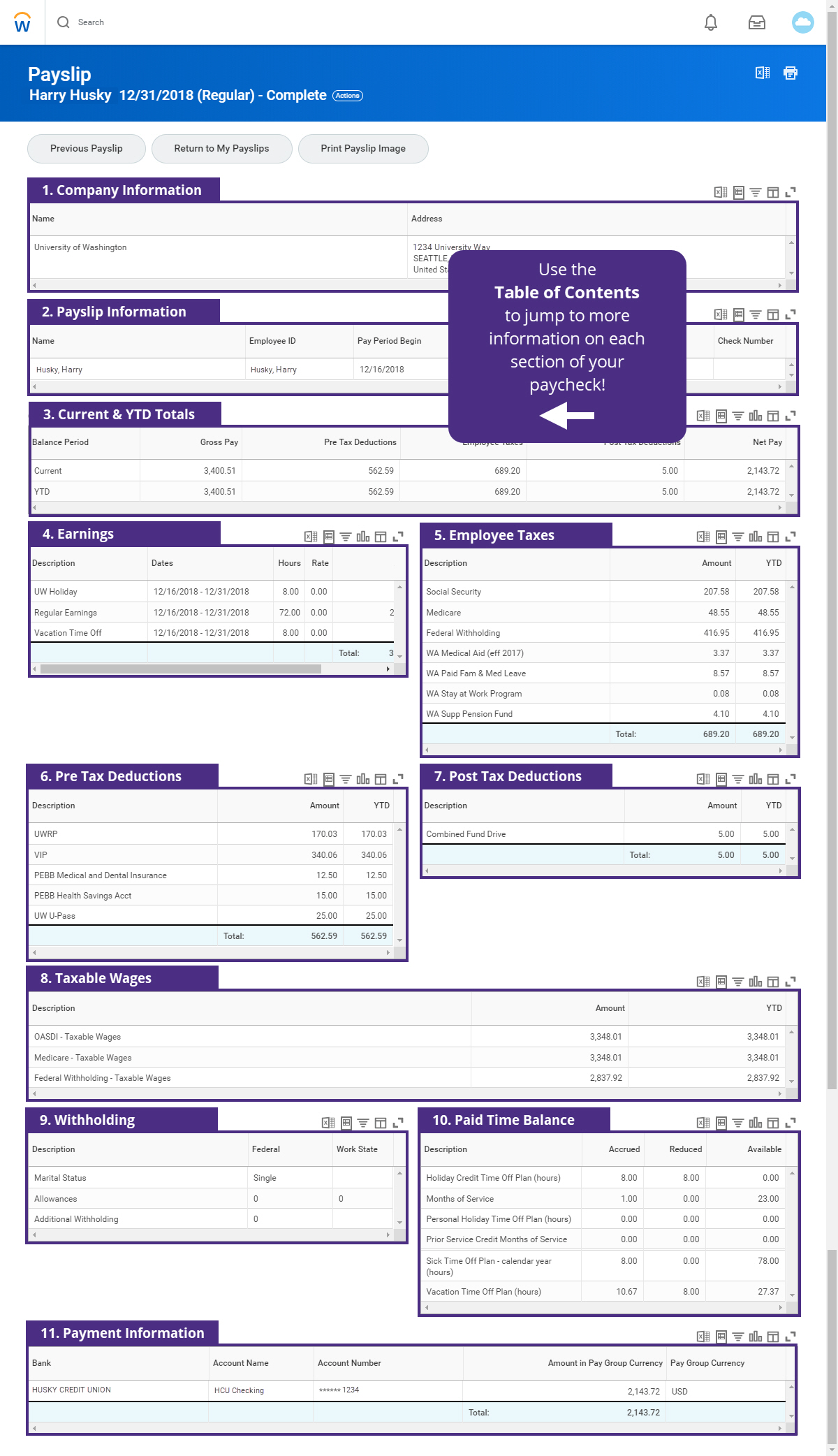

How To Read Your Payslip Integrated Service Center

The Real Numbers In Your Paycheck Southpoint Financial Credit Union

What Are Itemized Deductions And Who Claims Them Tax Policy Center

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android